Table of Contents:

- Scope and Applicability

- Core Difference: Federal Retreat vs. State Expansion

- Beneficial Owner Definitions

- Reporting Requirements and Data Collection

- Exemptions: Same Categories, Very Different Behavior

- Annual Filing Requirement

- Filing Deadlines

- Confidentiality and Public Access

- Penalties and Enforcement

- Legislative Uncertainty Still Matters

- Practical Compliance Reality

- The Bottom Line

IMPORTANT UPDATE: Please refer to our most recent post for the newest information on the New York LLC Transparency Act HERE.

If you operate or manage LLCs in New York, one of the most confusing compliance questions right now is this: What is the difference between NY BOI reporting and the federal CTA (Corporate Transparency Act)?

The short answer is that they are no longer aligned.

While the federal CTA has narrowed dramatically, New York has moved in the opposite direction by creating an independent, state-level reporting regime that applies to LLCs, regardless of federal status.

Below is a clear breakdown of how the two systems differ, why federal exemptions do not protect New York LLCs, and what that means in practice.

Scope and Applicability

Federal Corporate Transparency Act (Current Status)

When the CTA was enacted, it applied broadly to domestic corporations, LLCs, and similar entities. That changed in March 2025.

Under FinCEN’s interim final rule:

Domestic U.S. entities are exempt

Only foreign entities registered to do business in the U.S. must report

Federal BOI reporting is effectively paused for most U.S. companies

This is a major contraction of federal scope.

New York LLC Transparency Act

New York did not follow this narrowing.

Under NYLTA:

Applies only to LLCs

Covers:

New York–formed LLCs

Foreign LLCs authorized to do business in New York

Does not apply to corporations or LPs

Becomes effective January 1, 2026

Even if an LLC is fully exempt under the federal CTA, it may still be fully reportable in New York.

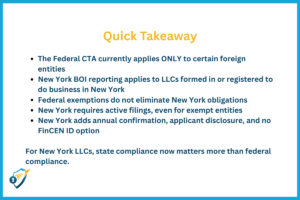

Core Difference: Federal Retreat vs. State Expansion

The most important distinction is structural.

The federal system pulled back

New York doubled down

As a result, New York LLCs cannot rely on federal exemption status to avoid state compliance.

Beneficial Owner Definitions

On this point, the two laws are aligned.

Both define a beneficial owner as an individual who:

Owns or controls 25% or more of ownership interests, or

Exercises substantial control over the entity

There is no meaningful difference in how beneficial owners are identified. The divergence begins after identification.

Reporting Requirements and Data Collection

What Both Require

Both regimes collect:

Full legal name

Date of birth

Residential or business address

Government-issued ID number

Where New York Goes Further

New York imposes additional burdens not present in the current federal framework.

Applicant Disclosure

Federal CTA: required only for entities formed on or after January 1, 2024

New York: required for all LLCs, including those formed years ago

FinCEN Identifier

Federal CTA: allows use of a FinCEN ID to avoid re-entering personal data

New York: no equivalent exists

Every filing requires full personal data again.

Document Submission

Federal CTA: requires copies of ID documents

New York: does not require document uploads but requires more frequent filings

Exemptions: Same Categories, Very Different Behavior

Both laws recognize the same 23 exemption categories, including:

Banks

Public companies

Large operating companies

Certain nonprofits

Regulated financial entities

The difference is what happens next.

Federal CTA Exemptions

Under the CTA:

If you are exempt, you do nothing

No filing

No confirmation

No renewal

Exemptions are self-executing.

New York Exemptions

Under NYLTA:

Exempt LLCs must file

They must submit an Attestation of Exemption

The attestation must:

Identify the exemption

Provide supporting facts

Be signed under penalty of perjury

New York converts exemption into an active compliance obligation.

Annual Filing Requirement

This is another major divergence.

Federal CTA: event-based updates only

New York: mandatory annual confirmation

Every LLC must file annually:

Reporting LLCs confirm or update BOI

Exempt LLCs confirm exemption status

There is no equivalent annual requirement under federal law.

Filing Deadlines

Federal CTA (Current)

Domestic entities: no filing required

Foreign entities: 30 days from U.S. registration

Updates: within 30 days of changes

New York LLC Transparency Act

Existing LLCs: file by January 1, 2027

New LLCs (post-2026): file within 30 days

All LLCs: annual filing required

New York’s calendar-style compliance is broader and more predictable, but also more burdensome.

Confidentiality and Public Access

Both systems now protect BOI data from public disclosure.

Federal: non-public FinCEN database

New York: non-public NYDOS database

However, New York publicly displays compliance status.

LLCs that miss deadlines may be marked:

“Past Due”

“Delinquent”

This visibility can affect banking, contracts, and transactions.

Penalties and Enforcement

Federal CTA

Civil penalties: up to $500 per day

Criminal penalties for willful violations

Enforced by FinCEN and DOJ

New York

“Past due” status after 30 days

“Delinquent” after two years

$250 initial penalty

Up to $500 per day ongoing

Possible suspension or dissolution by Attorney General

New York penalties are civil and administrative, but the operational risk is significant.

Legislative Uncertainty Still Matters

As of December 2025, New York lawmakers have acted to preserve state-level reporting regardless of federal changes. Pending legislation would confirm that NYLTA applies to both domestic and foreign LLCs.

The intent is clear: New York does not plan to follow federal retrenchment.

Practical Compliance Reality

For New York LLCs:

Federal exemption does not remove state obligations

Exempt entities still file annually

Applicant data must be tracked long-term

No FinCEN ID shortcut exists

For foreign LLCs in New York:

Dual compliance may apply

Separate systems and timelines must be managed

The Bottom Line

The difference between NY BOI reporting and the federal CTA is not technical. It is structural.

Where the federal BOI is currently narrow and limited, the New York BOI is broad, active, and recurring. Exemptions reduce data disclosure, not filing obligations, and annual compliance is unavoidable for New York LLCs.

If you manage LLCs connected to New York, state compliance now carries more weight than federal compliance, and planning around that reality is no longer optional.