Table of Contents:

- Important Legislative Context (December 2025)

- Who Is Covered by NY BOI Rules?

- The 23 Exemptions New York Recognizes

- Financial Institutions and SEC-Regulated Entities

- Investment and Fund-Related Exemptions

- Insurance and Other Regulated Businesses

- Tax-Exempt and Nonprofit Organizations

- Operating Company Exemptions (Most Common, Most Misunderstood)

- What Most LLCs Get Wrong About Exemptions

- What Exempt LLCs Must Still File

- Filing Deadlines for Exempt LLCs

- Penalties for Not Filing

- Bottom Line: Am I Exempt From NY BOI Reporting?

IMPORTANT UPDATE: Please refer to our most recent post for the newest information on the New York LLC Transparency Act HERE.

If you operate an LLC in New York, one of the most common questions right now is simple but critical: Am I exempt from NY BOI reporting?

The answer is often misunderstood.

Even if your LLC qualifies for an exemption, you are still required to file with New York.

There is no “do nothing” option under New York’s Beneficial Ownership rules.

Below is a clear, practical breakdown of who is exempt, what exemption actually means in New York, and what exempt LLCs are still required to file.

Important Legislative Context (December 2025)

As of mid-December 2025, there is pending legislation that could affect the final scope of NY BOI reporting. Governor Hochul has until December 19, 2025 to act on Senate Bill S8432, which would clarify that NYLTA applies broadly to both domestic and foreign LLCs.

This article assumes the bill is signed and the full exemption framework applies. LLCs should continue monitoring New York Department of State guidance for updates.

Who Is Covered by NY BOI Rules?

Before asking whether you are exempt, you need to confirm whether your entity is in scope.

You are covered by NY BOI rules if your entity is:

A New York LLC (formed by filing Articles of Organization with NYDOS), or

A foreign LLC (formed elsewhere but registered to do business in New York)

If your entity is an LLC and touches New York, you must file either:

A BOI report, or

An attestation of exemption

The 23 Exemptions New York Recognizes

New York adopted the same 23 exemption categories used in the federal Corporate Transparency Act. However, New York applies them differently.

Below is a structured overview of those exemptions.

Financial Institutions and SEC-Regulated Entities

These entities are generally exempt because they are already subject to extensive federal or state oversight.

Common exemptions include:

Public companies reporting under the Securities Exchange Act

Federal, state, local, or tribal government entities

Banks and bank holding companies

Credit unions

SEC-registered broker-dealers

Securities exchanges and clearing agencies

Registered money services businesses

These exemptions typically apply to large, heavily regulated organizations, not small operating LLCs.

Investment and Fund-Related Exemptions

Certain investment structures qualify for exemptions, including:

SEC-registered investment companies

SEC-registered investment advisers

Venture capital fund advisers that file Form ADV

Certain pooled investment vehicles advised by regulated entities

Important limitation: subsidiaries of pooled investment vehicles are not exempt unless they meet separate criteria.

Insurance and Other Regulated Businesses

New York recognizes exemptions for:

Insurance companies

State-licensed insurance producers with a physical U.S. office

Public accounting firms registered under Sarbanes-Oxley

Regulated public utilities

Certain financial market utilities

Again, these exemptions generally apply to regulated operating entities, not holding companies.

Tax-Exempt and Nonprofit Organizations

Entities that qualify under the Internal Revenue Code may be exempt, including:

501(c) tax-exempt organizations

Certain political organizations

Charitable trusts under Section 4947

Important clarification:

Losing 501(c) status triggers a 180-day grace period

“Nonprofit” in name alone does not qualify. IRS status controls.

Entities that exist solely to support tax-exempt organizations may also qualify, but the ownership and funding requirements are strict.

Operating Company Exemptions (Most Common, Most Misunderstood)

Large Operating Company Exemption

This exemption applies only if all three conditions are met:

More than 20 full-time U.S. employees

More than $5 million in U.S. gross receipts on the prior tax return

A physical operating office in the United States

Most small businesses and holding LLCs do not qualify.

Subsidiary of an Exempt Entity

An LLC may be exempt if it is:

100% owned or 100% controlled by certain exempt entities

Partial ownership does not qualify. FinCEN and New York interpret “controlled” strictly.

Inactive Entity Exemption

This exemption is extremely narrow. To qualify, an LLC must meet all six criteria:

Existed before January 1, 2020

No active business operations

No foreign ownership

No ownership changes in the last 12 months

Less than $1,000 in financial activity

No assets anywhere

Very few entities qualify.

What Most LLCs Get Wrong About Exemptions

Common misconceptions include:

Being unprofitable does not create an exemption

Single-member LLCs are not exempt

Real estate holding LLCs are not exempt

Passive income does not qualify as inactivity

HOAs not classified under 501(c) are not exempt

For most small businesses and real estate LLCs, BOI reporting is required.

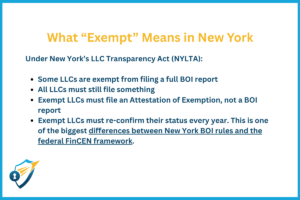

What Exempt LLCs Must Still File

This is the critical New York difference.

Even if your LLC is exempt, you must file:

An Attestation of Exemption

This filing must include:

The specific exemption claimed

Facts supporting the exemption

A certification signed under penalty of perjury

Annual Confirmation

Every exempt LLC must also file an annual statement confirming the exemption still applies.

Federal rules do not require this. New York does.

Filing Deadlines for Exempt LLCs

LLCs existing before January 1, 2026: file by January 1, 2027

LLCs formed or registered after January 1, 2026: file within 30 days

Missing deadlines triggers the same penalties as non-exempt entities.

Penalties for Not Filing

Failure to file an exemption attestation can result in:

Public “past due” status after 30 days

“Delinquent” status after two years

Fines up to $500 per day

Possible suspension or dissolution by the Attorney General

Exempt status does not reduce enforcement risk.

Bottom Line: Am I Exempt From NY BOI Reporting?

Here is the simplest way to think about it:

If your entity is an LLC in New York, you must file

Exempt LLCs file an attestation, not a BOI report

Non-exempt LLCs file a full BOI report

Everyone files annually

If you manage or form LLCs at scale, exemption analysis is going to be a recurring compliance workflow.